Weekly Token Unlocks Digest: Feb 16–22, 2026 | Insider Unlocks and Emission Shifts

Supply is back in focus. From large insider unlocks to new TGE structures and evolving token buyback models, this week highlights how distribution design is shaping market outcomes.

In this report, we break down $ZRO and $YZY unlock risks, Backpack’s growth-triggered TGE model, USDai’s $CHIP public sale mechanics, and Jupiter’s latest tokenomics proposal — and what each means for forward supply dynamics.

🔑 Key Takeaways

- $ZRO & $YZY: Insider-heavy unlocks remain a near-term overhang, especially in thin liquidity conditions.

- Backpack TGE: 25% initial float with growth-triggered unlocks signals a shift toward performance-based emissions.

- USDai $CHIP Sale: 100% unlocked at TGE introduces potential early volatility despite a whitelisted structure.

- $JUP Proposal: Supply restructuring could neutralize over 100% of projected circulating expansion, materially reducing forward dilution risk.

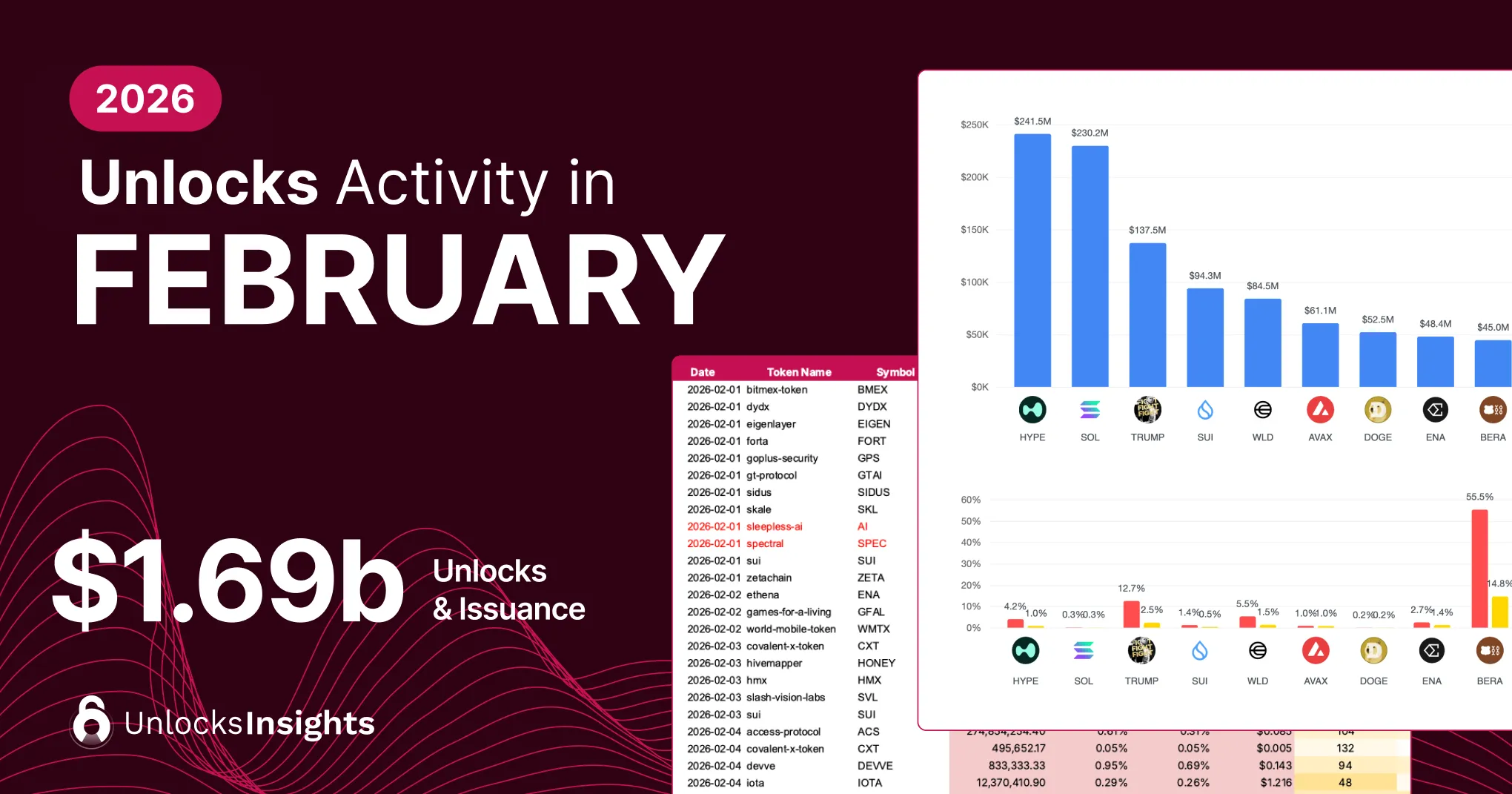

Weekly Unlocks Recap

Crypto markets remained in a defensive posture, with continued volatility and weak risk appetite. Bitcoin and Ethereum both finished the week up around 3%, recovering from mid-week volatility as prices stabilized near key support levels. While the rebound suggests some dip-buying interest, broader altcoin performance remained mixed, and overall market sentiment stayed cautious rather than decisively risk-on.

Looking ahead, a key macro event drawing attention is the scheduled Feb 20 U.S. Supreme Court opinion day on the Trump tariffs case, with prediction markets pricing a higher probability that the Court will rule the tariffs illegal. This binary legal outcome could trigger short-term volatility across equity and crypto markets as traders reposition around policy risk.

BREAKING: The US Supreme Court announces that February 20th will be its next opinion day as markets await their ruling on the legality of President Trump's tariffs.

— The Kobeissi Letter (@KobeissiLetter) February 13, 2026

Against this fragile macro backdrop, tokens with the highest emissions over the past 30 days have broadly underperformed. The top five projects by net supply increase all posted negative price action, including $ONDO, $RIVER, and $TRUMP. In a liquidity-constrained environment, expanding circulating supply has amplified downside pressure, as incremental demand has struggled to absorb new tokens entering the market.

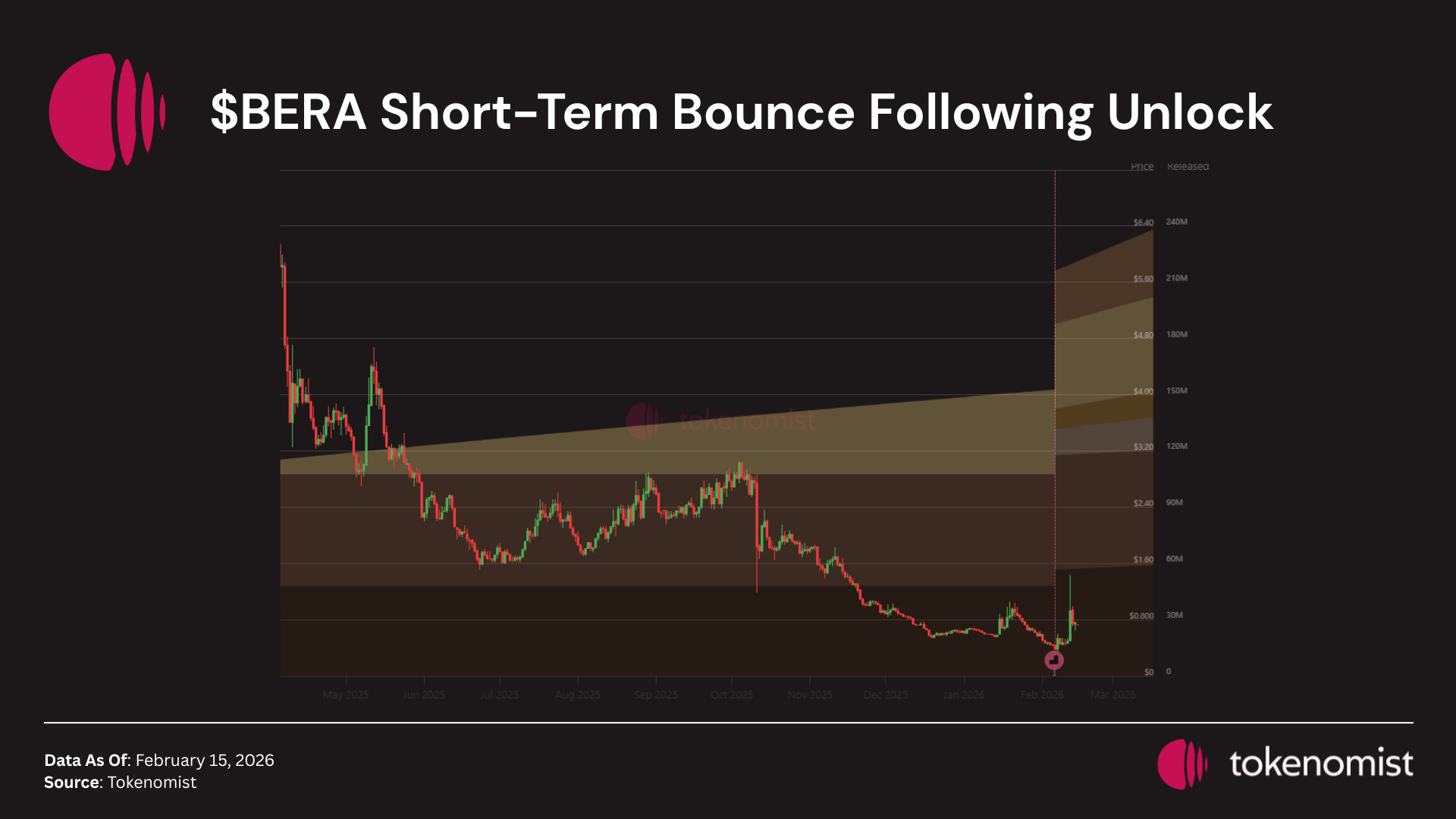

Meanwhile, $BERA has staged a short-term bounce. However, zooming out, the broader trend remains decisively bearish. Since TGE, price action has been structurally weak, and the recent rebound appears more consistent with a relief rally than a confirmed reversal.

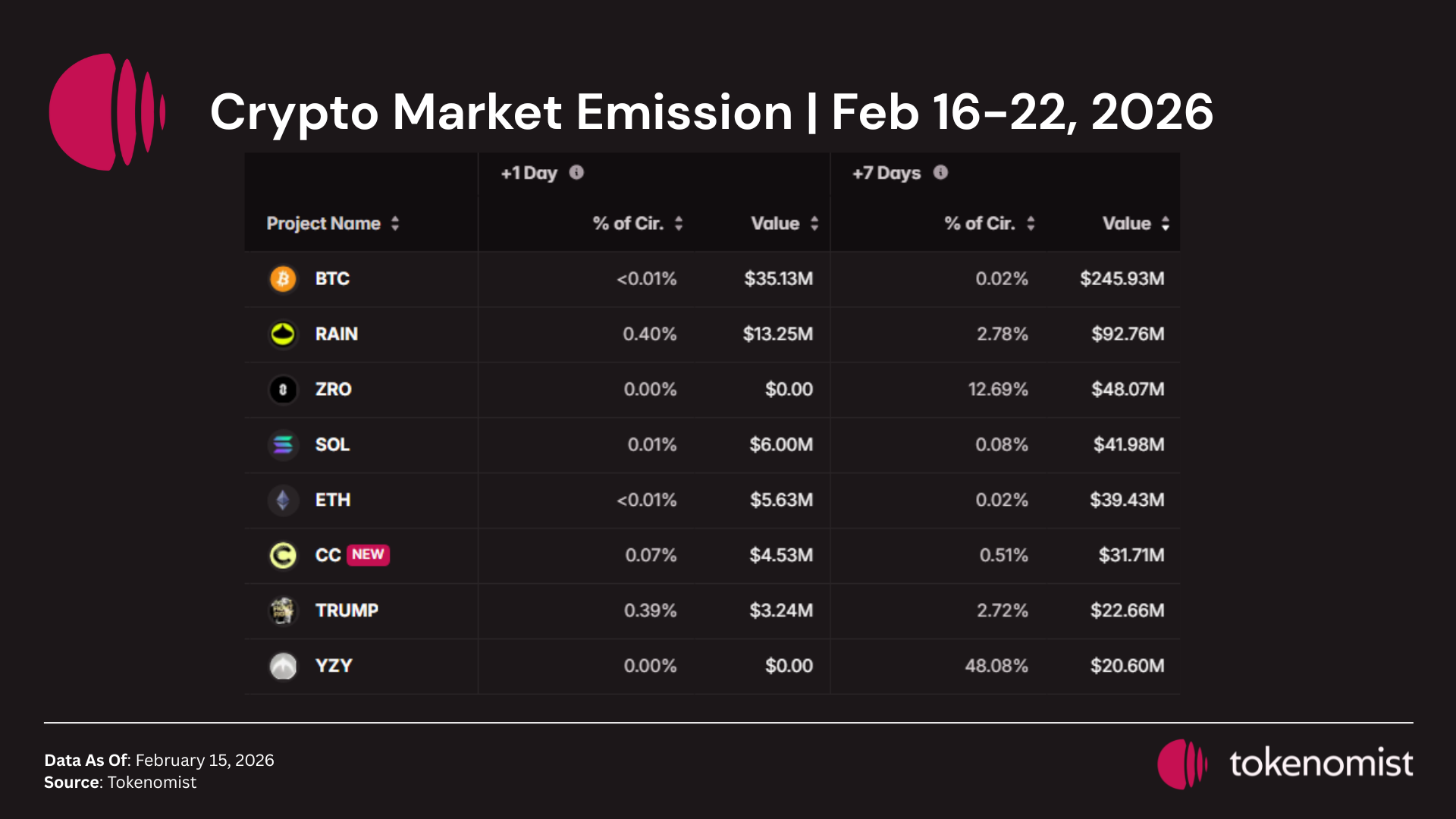

Upcoming Events

Next week’s scheduled token releases are set to exceed $700 Million in total value. Notable tokens facing sizable releases include $BTC, $RAIN, $ZRO, $SOL, and $ETH.

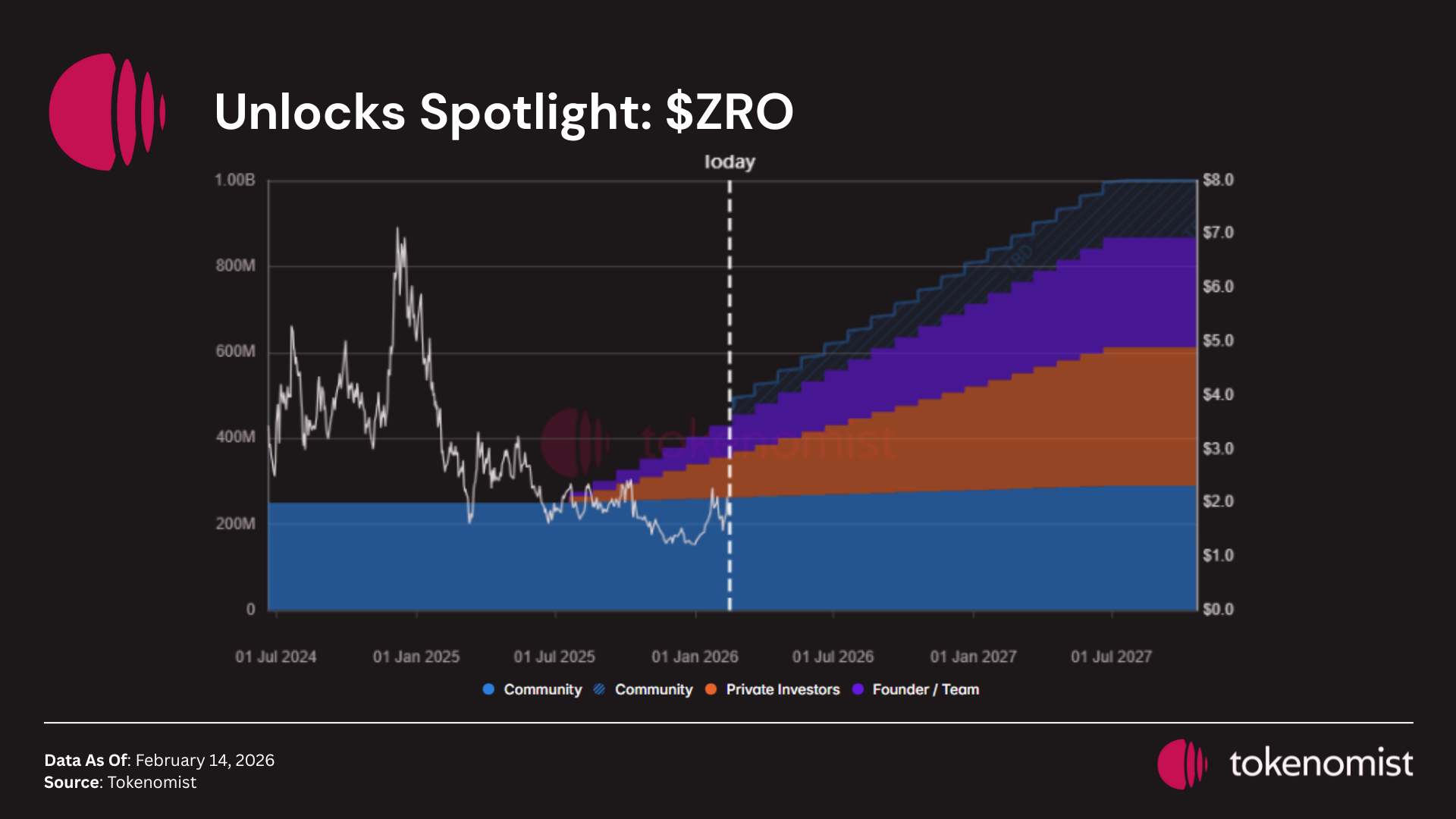

Unlocks Spotlight: $ZRO

- Unlock Date: February 20, 2026

- Amount: $46M

- Unlock as % of Circulating Supply: 5.98%

- Vested Allocations: Strategic Partners, Core Contributors, and Token Repurchased

$ZRO records the largest unlock by dollar value in the coming week, with all of the vested allocation going to insiders. This concentration increases the risk of near-term sell pressure, particularly if early backers look to de-risk in a fragile liquidity environment.

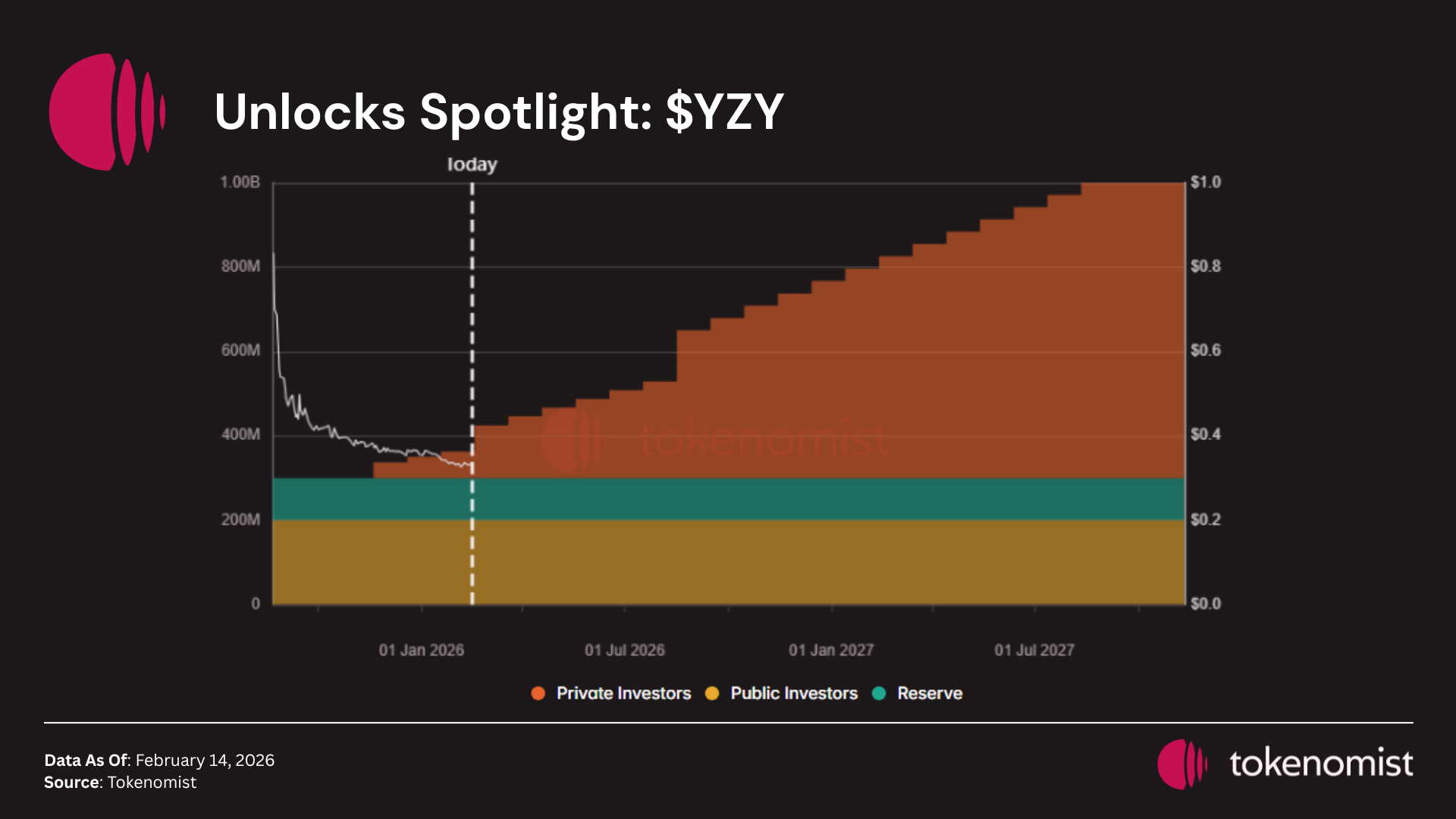

Unlocks Spotlight: $YZY

- Unlock Date: February 17, 2026

- Amount: $20M

- Unlock as % of Circulating Supply: 17%

- Vested Allocations: Private Investors

$YZY continues its ongoing insider unlock schedule, positioning it as a potential volatility trigger in the upcoming week. Since TGE, price action has been consistently weak, reflecting a pattern commonly observed in celebrity-driven tokens—initial hype followed by sustained distribution.

New TGEs on the Radar

Backpack, an all-in-one crypto wallet and exchange, has officially unveiled its tokenomics and initial distribution framework.

Token Overview

- Total Supply: 1 billion tokens

- Initial TGE Supply: 250 million tokens (25%)

TGE Allocation

- 24% allocated to points holders

- 1% allocated to Mad Lads NFT holders

This means the entire initial circulating supply is community-facing, with no immediate insider-heavy float at launch — a structure that may help support early market stability.

The remaining 75% of supply will follow a growth-triggered unlock model, where emissions are tied to predefined performance milestones. This mirrors the KPI-gated approach adopted by MegaETH, signaling a broader shift toward aligning token distribution with ecosystem traction rather than fixed timelines.

25% on TGE

— Backpack 🎒 (@Backpack) February 9, 2026

Here's the entire token distribution

Utility coming next 🎒 pic.twitter.com/O7gyL7WP4v

Public Sale Watch

USDai Protocol, a stablecoin project backed by AI/GPU infrastructure loans, has announced the ICO of its governance token $CHIP on CoinList.

The sale will be conducted as a whitelisted offering, exclusively available to users who participated in USD.AI’s Allo Game program. Participants will receive guaranteed allocations based on the number of points accumulated through the campaign, effectively rewarding prior ecosystem engagement.

Key Sale Details

- Total Supply: 10,000,000,000 CHIP

- Sale Allocation: 700,000,000 CHIP (7%)

- Fully Diluted Valuation (FDV): $300M

- Unlock Schedule: 100% unlocked at TGE (expected March 2026)

- Sale Period: February 22–27, 2026

With the entire sale allocation unlocked at TGE, initial circulating supply dynamics will be critical to monitor. While the whitelisted structure reduces immediate flipping from broader retail participation, the absence of vesting introduces potential short-term volatility post-listing. Market absorption will likely depend on perceived protocol traction and demand for exposure to AI-linked stablecoin infrastructure narratives.

Whitelist sales are back with @USDai_Official

— CoinList (@CoinList) February 12, 2026

• Exclusive for participants in https://t.co/QyrcnIw987’s Allo Game (whitelist)

• Guaranteed allocation based on points earned

• Commit above your guarantee → pro rata if the sale doesn’t sell out

• 100% unlock at TGE (March… pic.twitter.com/QfcR8EkyYz

Notable Tokenomics Update

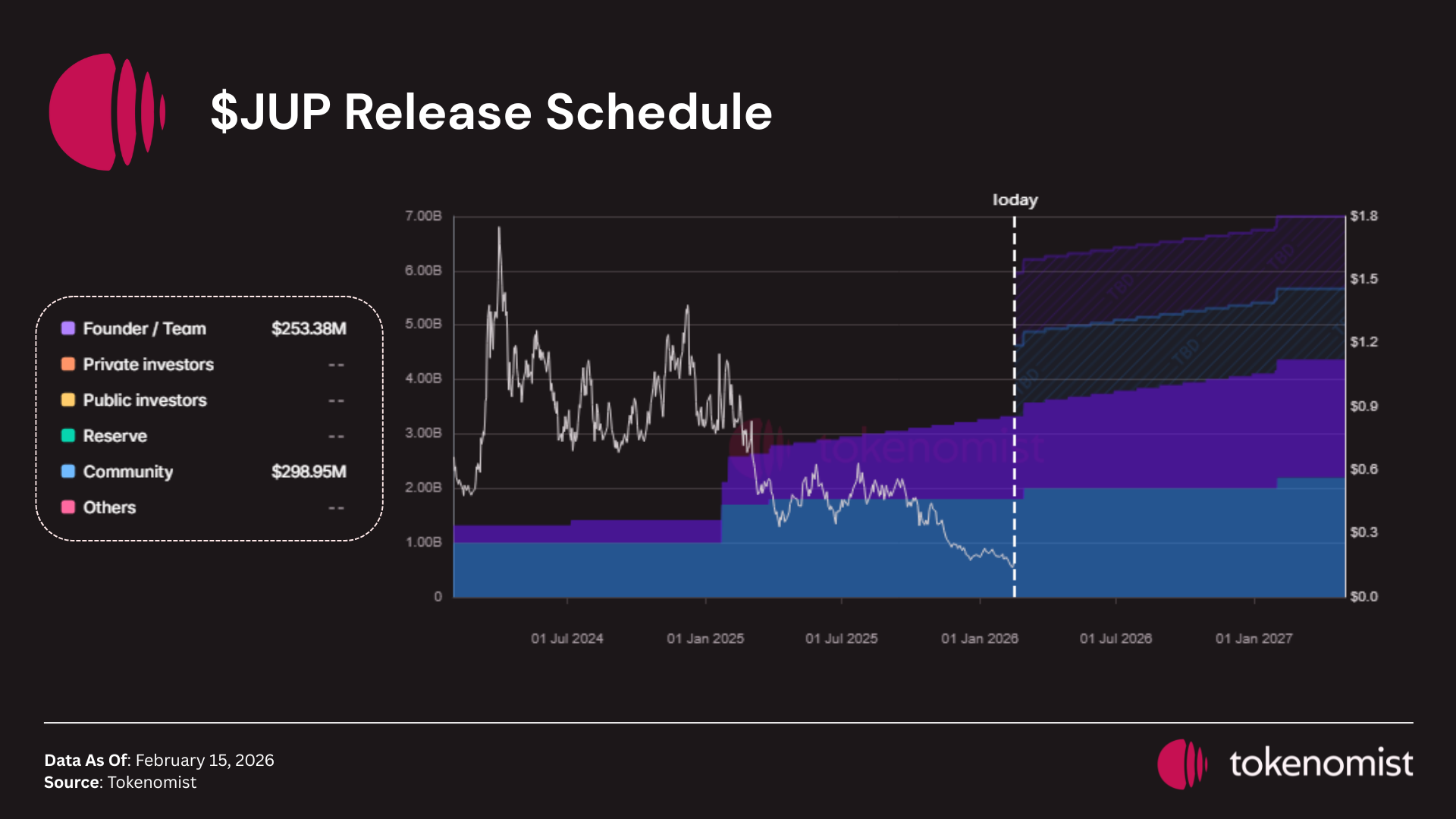

Jupiter’s native token $JUP continues to evolve its tokenomics framework in an effort to balance community incentives with long-term supply discipline. Originally launched as one of the largest airdropped tokens in crypto history, JUP’s 10 billion supply was structured with a 50/50 split between community and team allocations, with a major community focus via the annual “Jupuary” airdrop series.

Jupiter has implemented a fee-driven buyback mechanism, allocating 50 % of protocol revenue toward buying back JUP tokens that are then locked or removed from circulation. These moves are explicitly intended to create recurring buy pressure and reduce net circulating supply growth over time.

Most recently, the community has discussed a proposal aimed at zero net JUP emissions in 2026 by restructuring scheduled distributions, highlighting active efforts to rethink long-term supply dynamics in light of price pressure and evolving usage patterns.

Today we’re bringing forward an important proposal to effectively bring net emissions to zero for the foreseeable future.

— Jupiter (@JupiterExchange) February 13, 2026

This involves:

1. Pausing emissions from the Team Reserve indefinitely

2. Absorbing any team sales of vesting tokens in the Jupiter treasury

3. Postponing… pic.twitter.com/Azx5hJfZoi

The proposed restructuring would effectively pause more than 100% of the currently projected circulating supply expansion from entering the market over the coming periods. In practical terms, this means the net new emissions scheduled under the prior framework could be fully neutralized, significantly reducing forward dilution risk.